Stock

Stock As of Mar. 31, 2024

Stock Information

-

Total number of shares authorized

640,000,000 shares

-

Total number of shares issued

307,833,172 shares

-

Number of shareholders

19,052 persons

(Number of unit shareholders' in the above: 17,633 persons)

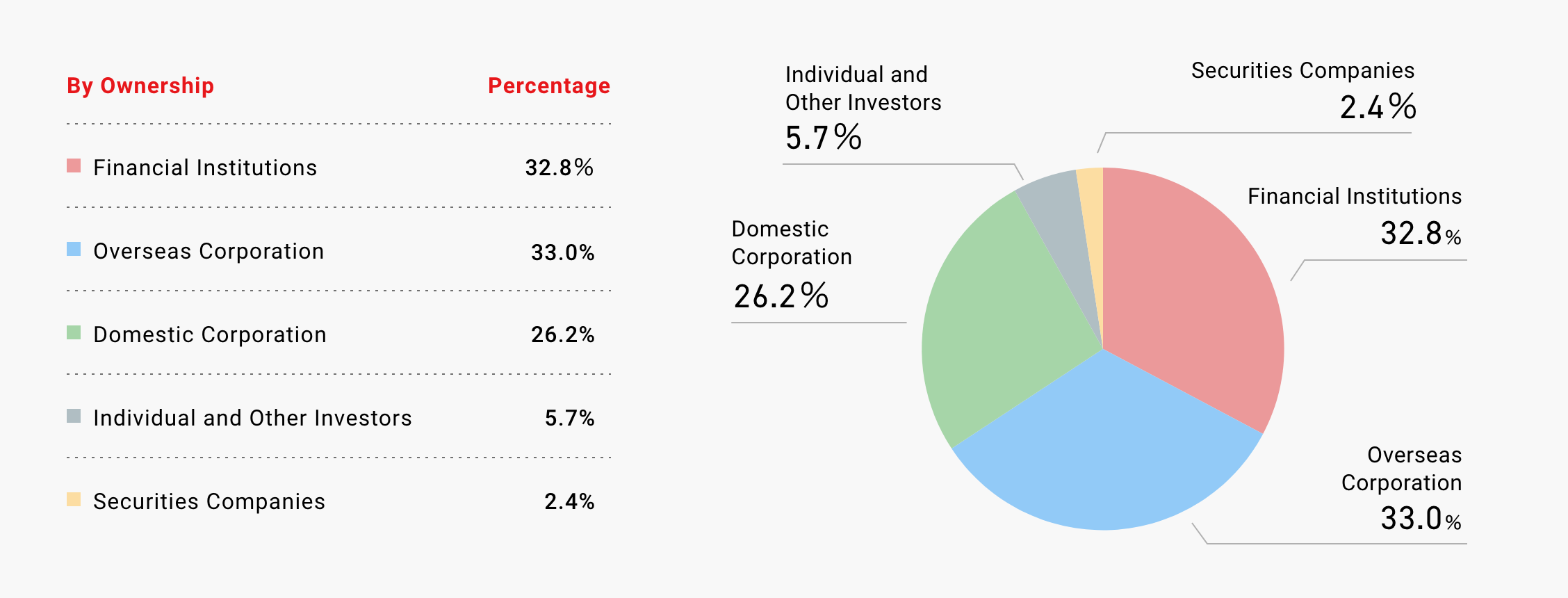

State of Distribution of Stocks by Shareholders (in number of stocks)

Major Shareholders

| Shareholders |

Shares |

|---|---|

| TOYOTA MOTOR CORPORATION | 64,316 |

| The Master Trust Bank of Japan, Ltd. (Trust account) | 33,712 |

| Custody Bank of Japan, Ltd. (Trust account) | 10,643 |

| Nippon Life Insurance Company | 9,688 |

| Sumitomo Mitsui Banking Corporation | 8,164 |

| The Dai-ichi Life Insurance Company, Limited | 8,001 |

| MUFG Bank, Ltd. | 7,731 |

| CEP LUX-ORBIS SICAV | 6,597 |

| SUMITOMO LIFE INSURANCE COMPANY | 4,794 |

| JPMorgan Securities Japan Co., Ltd. | 4,060 |

Notes

(1) Fractions of less than one thousand stocks are disregarded.

(2) The above "Major Shareholders" excludes treasury stock.s

Status of Dividends

Dividend (per share)

| FY 2021 | FY 2022 | FY 2023 | FY 2024 | FY 2025 | |

|---|---|---|---|---|---|

| Interim Dividend | 10 Yen | 12 Yen | 12 Yen | 25 Yen |

28 Yen (Plan) |

| Year-end Dividend | 15 Yen | 15 Yen | 16 Yen | 28 Yen | 28 Yen (Plan) |

| Full-year | 25 Yen | 27 Yen | 28 Yen | 53 Yen | 56 Yen (Plan) |

Note:

A 2-for-1 stock split of common stock was conducted, effective October 1, 2022.

The dividends per share stated above are calculated assuming the stock split was conducted at the beginning of the fiscal 2021, the year ending March 31, 2021.

Stock Information

-

Fiscal Year

From April 1 to March 31

-

Dividend Receivable Date of Settlement of Eligible Shareholders

March 31

September 30

(Interim dividends when declared) -

General Meeting of Shareholders

June (Once a year)

-

Shareholder Registry Administrator Account Management Institution Mitsubishi UFJ Trust and Banking Corporation Contact

Mitsubishi UFJ Trust and Banking Corporation

Corporate Agency Department

1-1, Nikko-cho, Fuchu-shi, Tokyo, Japan

Tel. 81-42-204-0303 -

Stock Exchange

Tokyo Stock Exchange

-

Method of Public Notice

Public notices are issued electronically.

However, in the event where a public notice cannot be issued electronically due to an accident or other unavoidable cause, it will be posted in the Nihon Keizai Shimbun.

Public Notice URL : https://www.koito.co.jp/english

【CAUTION】

(1) In principle, changes of shareholders' addresses, purchase requests, designation of dividend transfers, and various other procedures should be handled by the account management institution (securities company, etc.) where the shareholder has opened an account. Please contact the securities company, etc. where you have opened an account. Please note that the shareholder registry administrator (Mitsubishi UFJ Trust and Banking Corporation) cannot handle this procedure.

(2) For various procedures regarding shares recorded in the special account, please contact the account management institution for the above special account (Mitsubishi UFJ Trust and Banking Corporation), as Mitsubishi UFJ Trust and Banking Corporation is the account management institution. The head office and branches nationwide of Mitsubishi UFJ Trust and Banking Corporation will also serve as the agent for these procedures.

(3) Unclaimed dividends will be paid at the head office and branches of Mitsubishi UFJ Trust and Banking Corporation.

【INFORMATION】

(1) Withholding tax rate on dividends, etc. from listed shares, etc.

As a general rule, a withholding tax rate of 20.315% (*) is applied to dividends, etc. of listed shares, etc. paid by individual shareholders.

The withholding tax rate is 15% for income tax, 0.315% for special income tax for reconstruction, and 5% for inhabitant tax.

(*)Please note that the information in this guide may not apply to some shareholders.

For details, please contact your local tax office, tax accountant, etc.

(2) Receipt of dividends, etc. in a small amount investment tax-exempt account (NISA account)

In order to receive tax-exemption on dividends, etc., you must select the "allocation in proportion to the number of shares" method of receiving dividends, etc. through your account management institution (securities company, etc.) when you hold newly purchased shares of our company's stock in a NISA account.

Please note that in order to use the "allocation in proportion to the number of shares method" for year-end or interim dividends, the procedures must be completed by the "Shareholder Fixed Date for Dividend Receipt" for the year-end or interim dividend payment, respectively.

Please note that shareholders whose shares are recorded in a special account are not eligible to choose the "allocation based on the number of shares" method.

For more information on NISA accounts, please contact your securities company.